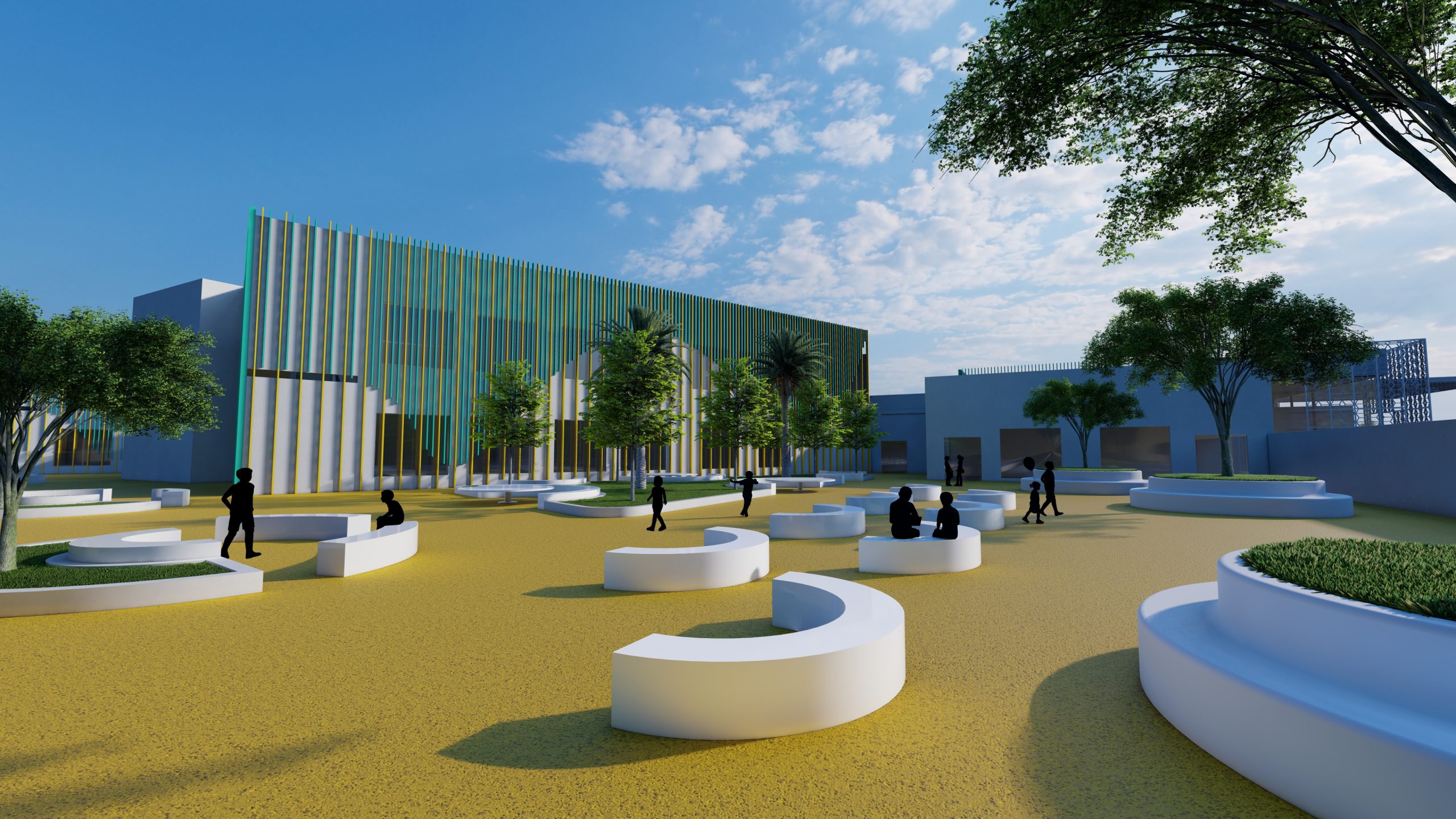

Zayed City Schools

UAE’s first school infrastructure public-private partnership.

The three schools will host 5,360 students from Kindergarten to cycle 3 with all the required facilities for Education.

Overview

To implement the Vision 2030 for the future Capital District of Abu Dhabi, the Abu Dhabi Department of Education and Knowledge (ADEK) procured the Zayed City Schools PPP Project to BESIX Plenary Education Properties Development, the Project Company, to finance, design, procure, construct, commission, operate and maintain three schools for 20 years.

To that end, the Project Company entered into a Partnership Agreement with ADEK governing all aspects of the Project. The Project Company is formed by a consortium between BESIX and Plenary Group who are the project Sponsors.

This is the UAE’s first schools infrastructure private-public partnership, a pioneering project that paves the way for private sector participation in the development on the country’s social infrastructure

BESIX Solution

This UAE’s first school ‘Zayed City Schools’ project is a major step in BESIX Group’s diversification strategy, positioning it as a partner of choice in achieving the United Arab Emirate’s social infrastructure development strategy between the public and the private sectors.

BESIX is involved in the project in a double capacity as investor and as facility manager for 20 years.

It confirms the position of the Group as a leading player in the implementation of large and ambitious public-private partnerships, offering governments a first-choice solution for the efficient and rapid implementation of their national strategies. To do so, BESIX has chosen to subcontract the design and build portion of this development to a local contractor while providing its expertise to the monitoring of the design and construction phase in the context of public private partnership. Moreover, BESIX is relying on a broad range of financing solutions, and expertise in facility management.

Structuring

The project is co-created with Plenary , a leading independent long- term investor, developer, and manager of public infrastructure, specialising in public-private partnerships. It currently has 75 assets under management worth more than US$38 billion across Australia, Canada, and the US.

The debt provider group comprises financial institutions HSBC, Intesa Sanpaolo, and The Norinchukin Bank. They provide a senior debt financing under a soft mini-perm structure with a long maturity

Back to case studies

Also in

Social Infrastructure